Tungsten, known for its high melting point, hardness, density, and excellent thermal conductivity, is widely used in industries such as automotive, military, aerospace, and machining, earning it the title of “industrial teeth.”

Since early May 2025, tungsten concentrate prices have exceeded 170,000 yuan per ton, and ammonium paratungstate (APT) prices have surpassed 250,000 yuan per ton, both reaching historical highs. Analysis indicates that domestic tungsten supply faces two major bottlenecks: total production control and resource depletion, revealing a supply-side ceiling. Meanwhile, new demand, particularly for photovoltaic tungsten wire, is expected to maintain strong growth. Under this tight supply-demand dynamic, tungsten prices are likely to remain elevated in the medium to long term.

On May 29, Zhongwu Online released data showing that domestic black tungsten concentrate (≥65%) prices broke through 170,000 yuan per ton for the first time, and APT prices surpassed 250,000 yuan per ton, both setting record highs. Analysis suggests that since the start of the year, tight tungsten concentrate supply and declining inventories have effectively supported tungsten prices. In the long term, limited supply growth due to resource depletion and global production controls, combined with sustained demand growth from sectors like photovoltaics, may widen the supply-demand gap, keeping tungsten prices in a high range.

According to Wind data, as of June 6, domestic black tungsten concentrate (≥65%) prices reached 173,000 yuan per ton, up 21.1% from the beginning of the year and 26.3% higher than the 2024 average. Similarly, white tungsten concentrate (≥65%) prices rose to 172,000 yuan per ton, up 21.2% from the start of the year and 26.6% above the 2024 average. Driven by rising tungsten concentrate prices, APT prices climbed to 252,000 yuan per ton, up 19.3% from the beginning of the year and 24.8% higher than the 2024 average. Previously, the Ministry of Commerce and General Administration of Customs jointly announced export controls on specific items, including tungsten, explicitly listing APT among 25 controlled rare metal products and technologies, alongside other tungsten-related items like tungsten oxide.

Downstream, cemented carbide is primarily used in cutting tools, wear-resistant tools, and mining tools, collectively accounting for over 90% of demand. According to Metalworking Magazine, in 2023, domestic tungsten cemented carbide tools accounted for 63% of the market, a significant increase from 2014. In contrast, traditional high-speed steel usage dropped from 28% in 2014 to 20% in 2023.

Currently, domestic cutting tools face three major trends: numerical control (CNC), systemization, and domestic substitution. Taking digitalization as an example, in 2024, domestic metal cutting machine tool output reached 690,000 units, with CNC cutting machine tools totaling 300,000 units, achieving a CNC adoption rate of 44%, showing steady improvement. However, compared to developed countries, China’s CNC adoption rate remains relatively low. For instance, Japan maintains a CNC adoption rate above 80%, while the United States and Germany exceed 70%.

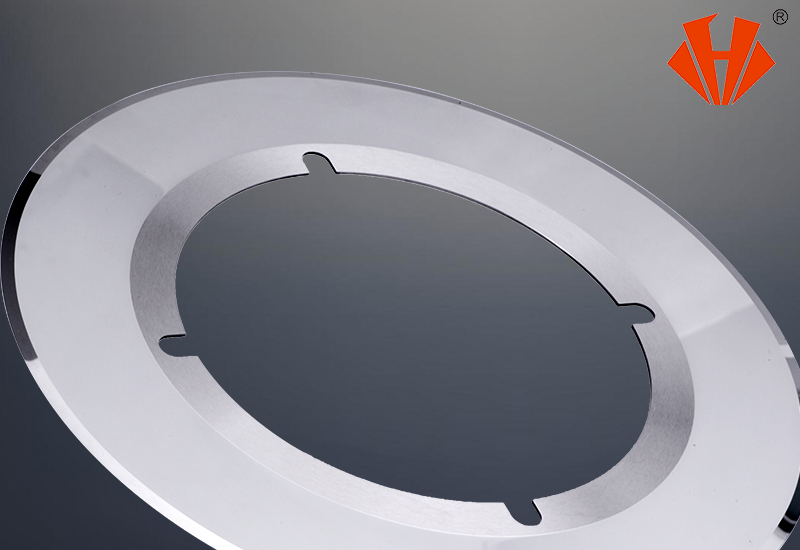

CHENGDU HUAXIN CEMENTED CARBIDE CO., LTD is a professional supplier and manufacturer of tungsten carbide products, such as carbide insert knives for woodworking, carbide circular knives for tobacco & cigarette filter rod slitting, round knives for corrugated cardboard slitting, three-hole razor blades/slotted blades for packaging, tape, and thin film cutting, and fiber cutter blades for the textile industry, among others.

Post time: Jul-03-2025