-

1C117.d. Tungsten-Related Materials:

-

Ammonium paratungstate (HS Code: 2841801000);

-

Tungsten oxides (HS Codes: 2825901200, 2825901910, 2825901920);

-

Tungsten carbides not controlled under 1C226 (HS Code: 2849902000).

-

-

1C117.c. Solid Tungsten with All of the Following Characteristics:

-

Solid tungsten (excluding granules or powders) with any of the following:

-

Tungsten or tungsten alloys with tungsten content ≥97% by weight, not controlled under 1C226 or 1C241 (HS Codes: 8101940001, 8101991001, 8101999001);

-

Tungsten-copper alloys with tungsten content ≥80% by weight (HS Codes: 8101940001, 8101991001, 8101999001);

-

Tungsten-silver alloys with tungsten content ≥80% and silver content ≥2% by weight (HS Codes: 7106919001, 7106929001);

-

-

Capable of being machined into any of the following:

-

Cylinders with diameter ≥120 mm and length ≥50 mm;

-

Tubes with inner diameter ≥65 mm, wall thickness ≥25 mm, and length ≥50 mm;

-

Blocks with dimensions ≥120 mm × 120 mm × 50 mm.

-

-

-

1C004. Tungsten-Nickel-Iron or Tungsten-Nickel-Copper Alloys with All of the Following Characteristics:

-

Density >17.5 g/cm³;

-

Yield strength >800 MPa;

-

Ultimate tensile strength >1270 MPa;

-

Elongation >8% (HS Codes: 8101940001, 8101991001, 8101999001).

-

-

1E004, 1E101.b. Technologies and Data for producing items under 1C004, 1C117.c, 1C117.d (including process specifications, parameters, and machining programs).

-

6C002.a. Metallic Tellurium (HS Code: 2804500001).

-

6C002.b. Single or Polycrystalline Tellurium Compound Products (including substrates or epitaxial wafers):

-

Cadmium telluride (HS Codes: 2842902000, 3818009021);

-

Cadmium zinc telluride (HS Codes: 2842909025, 3818009021);

-

Mercury cadmium telluride (HS Codes: 2852100010, 3818009021).

-

-

6E002. Technologies and Data for producing items under 6C002 (including process specifications, parameters, and machining programs).

-

6C001.a. Metallic Bismuth and Products not controlled under 1C229, including but not limited to ingots, blocks, beads, granules, and powders (HS Codes: 8106101091, 8106101092, 8106101099, 8106109090, 8106901019, 8106901029, 8106901099, 8106909090).

-

6C001.b. Bismuth Germanate (HS Code: 2841900041).

-

6C001.c. Triphenylbismuth (HS Code: 2931900032).

-

6C001.d. Tris(p-ethoxyphenyl)bismuth (HS Code: 2931900032).

-

6E001. Technologies and Data for producing items under 6C001 (including process specifications, parameters, and machining programs).

-

1C117.b. Molybdenum Powder: Molybdenum and alloy particles with molybdenum content ≥97% by weight and particle size ≤50×10⁻⁶ m (50 μm), used for manufacturing missile components (HS Code: 8102100001).

-

1E101.b. Technologies and Data for producing items under 1C117.b (including process specifications, parameters, and machining programs).

-

3C004.a. Indium Phosphide (HS Code: 2853904051).

-

3C004.b. Trimethylindium (HS Code: 2931900032).

-

3C004.c. Triethylindium (HS Code: 2931900032).

-

3E004. Technologies and Data for producing items under 3C004 (including process specifications, parameters, and machining programs).

-

APT exports in 2023 and 2024 were approximately 803 tons and 782 tons, respectively, each accounting for about 4% of total tungsten exports.

-

Tungsten trioxide exports were about 2,699 tons in 2023 and 3,190 tons in 2024, increasing from 14% to 17% of total exports.

-

Tungsten carbide exports were about 4,433 tons in 2023 and 4,147 tons in 2024, maintaining a share of about 22%.

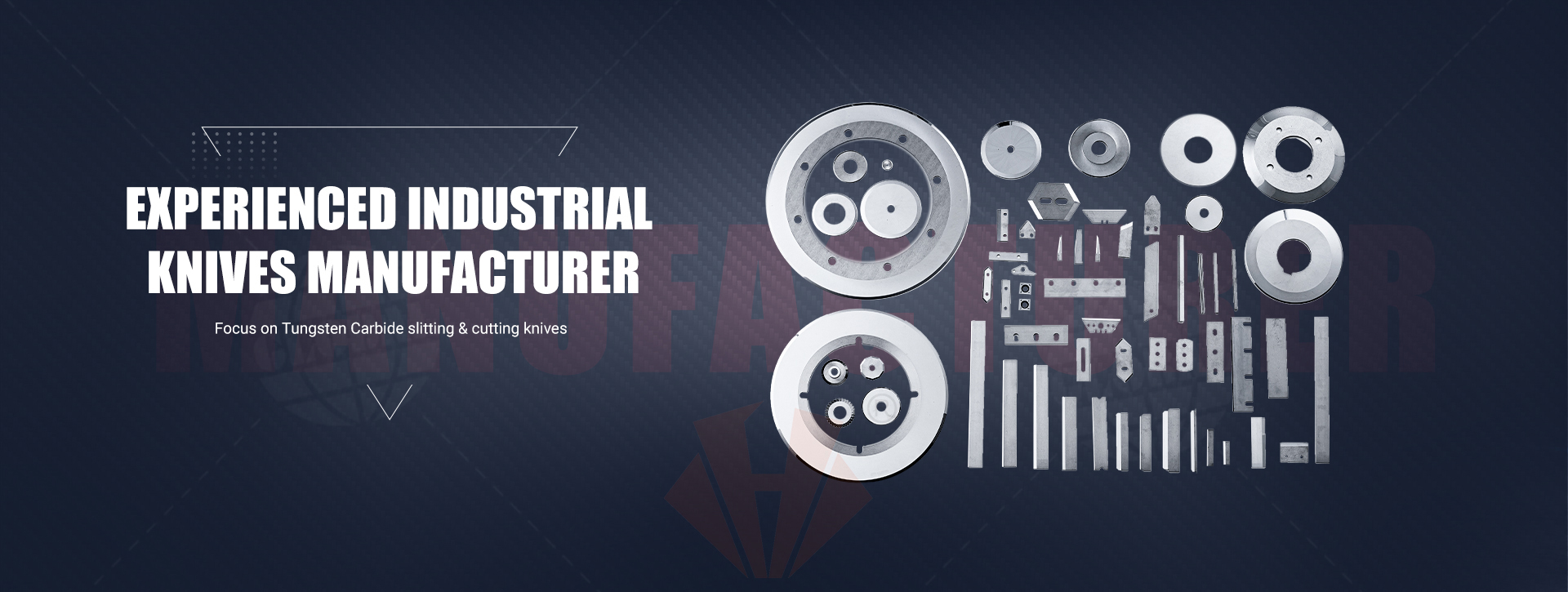

CHENGDU HUAXIN CEMENTED CARBIDE CO.,LTD are a professional supplier and manufacturer of tungsten carbide products, such as carbide insert knives for woodworking,carbide circular knives for tobacco&cigarette filter rods slitting,round knives for corugatted cardboard slitting ,three hole razor blades/slotted blades for packaging ,tape,thin film cutting,fiber cutter blades for textile industry etc.

With over 25 years development, our products have been exported to U. S. A, Russia, South America,India,Turkey,Pakistan,Australia,Southeast Asia etc. With excellent quality and competitive prices, Our hard working attitude and responsiveness are approved by our customers. And we would like to establish new business relationships with new customers.

Contact us today and you will enjoy benefits of good quality and services from our products!

Post time: Jun-04-2025