U.S.-China tariff disputes have increased tungsten prices, affecting carbide blade costs

What is Tungsten Carbide?

The on-going trade tensions between the United States and China have recently impacted the tungsten industry, a critical sector for global manufacturing.

As of January 1, 2025, the U.S. imposed a 25% tariff increase on certain tungsten products from China, a move announced by the U.S. Trade Representative (USTR) in December 2024 USTR Increases Tariffs Under Section 301 on Tungsten Products, Wafers, and Polysilicon.

As a part of broader efforts to address perceived unfair trade practices, This tariff hike has led to a significant rise in raw material costs for manufacturers of tungsten carbide blades, affecting companies like Huaxin Cemented Carbide.

Known for its high melting point and strength, Tungsten is essential for producing tungsten carbide, a key material in blades used across industries such as aerospace, automotive, electronics, packaging, and textiles.

Controlling a significant share of the market,China dominates global tungsten production, and this makes it particularly vulnerable to trade policies.

The U.S. tariff increase to 25%, effective from January 1, 2025, aims to protect domestic industries but has instead raised concerns about supply chain disruptions and cost escalations China's Comprehensive Retaliation Against U.S. Tariffs.

In response,China has imposed export controls on critical minerals, including tungsten, further complicating global trade dynamics.

Tungsten and its products prices in China

Tungsten prices continue to rise strongly. According to a survey conducted by China Tungsten Online, as of press time:

The price of 65% black tungsten concentrate is RMB 168,000/ton, with a daily increase of 3.7%, a weekly increase of 9.1%, and a cumulative increase of 20.0% in this round.

The price of 65% scheelite concentrate is RMB 167,000/ton, with a daily increase of 3.7%, a weekly increase of 9.2%, and a cumulative increase of 20.1% in this round.

Tungsten prices continue to rise strongly. According to a survey conducted by China Tungsten Online, as of press time:

The price of 65% black tungsten concentrate is RMB 168,000/ton, with a daily increase of 3.7%, a weekly increase of 9.1%, and a cumulative increase of 20.0% in this round.

The price of 65% scheelite concentrate is RMB 167,000/ton, with a daily increase of 3.7%, a weekly increase of 9.2%, and a cumulative increase of 20.1% in this round.

The market is full of speculation on the concept of strategic resources, which has led suppliers to be reluctant to sell and support price increases. As the price profit margin expands, miners are more motivated to produce, while downstream acceptance decreases.

The price of ammonium paratungstate (APT) is RMB 248,000/ton, with a daily increase of 4.2%, a weekly increase of 9.7%, and a cumulative increase of 19.8% in this round.

The market faces the dual pressures of high costs and shrinking orders. Production enterprises are cautious in resisting the risk of inversion, and procurement and shipment are relatively conservative. Traders enter and exit quickly, make profits through rapid turnover, and market speculation heats up.

The price of tungsten powder is RMB 358/kg, with a daily increase of 2.9%, a weekly increase of 5.9%, and a cumulative increase of 14.7% in this round.

Tungsten carbide powder is RMB 353/kg, with a daily increase of 2.9%, a weekly increase of 6.0%, and a cumulative increase of 15.0% in this round.

The loss pressure of cemented carbide enterprises has increased sharply, and they are less motivated to purchase high-priced raw materials, mainly digesting old inventory. The demand for tungsten powder products is weak, the market is rising, and the transaction volume is shrinking.

The price of 70 ferrotungsten is RMB 248,000/ton, with a daily increase of 0.81%, a weekly increase of 5.1%, and a cumulative increase of 14.8% in this round.

The dominant factor of the market situation comes from the tungsten raw material end. The overall price trend is upward, and the downstream procurement and stocking have slowed down relatively.

These prices suggest a market under pressure, with tungsten costs likely contributing to higher production expenses for carbide blade manufacturers. Given Huaxin Cemented Carbide’s reliance on tungsten, it seems likely that their operational costs have increased, potentially leading to higher prices for their products.

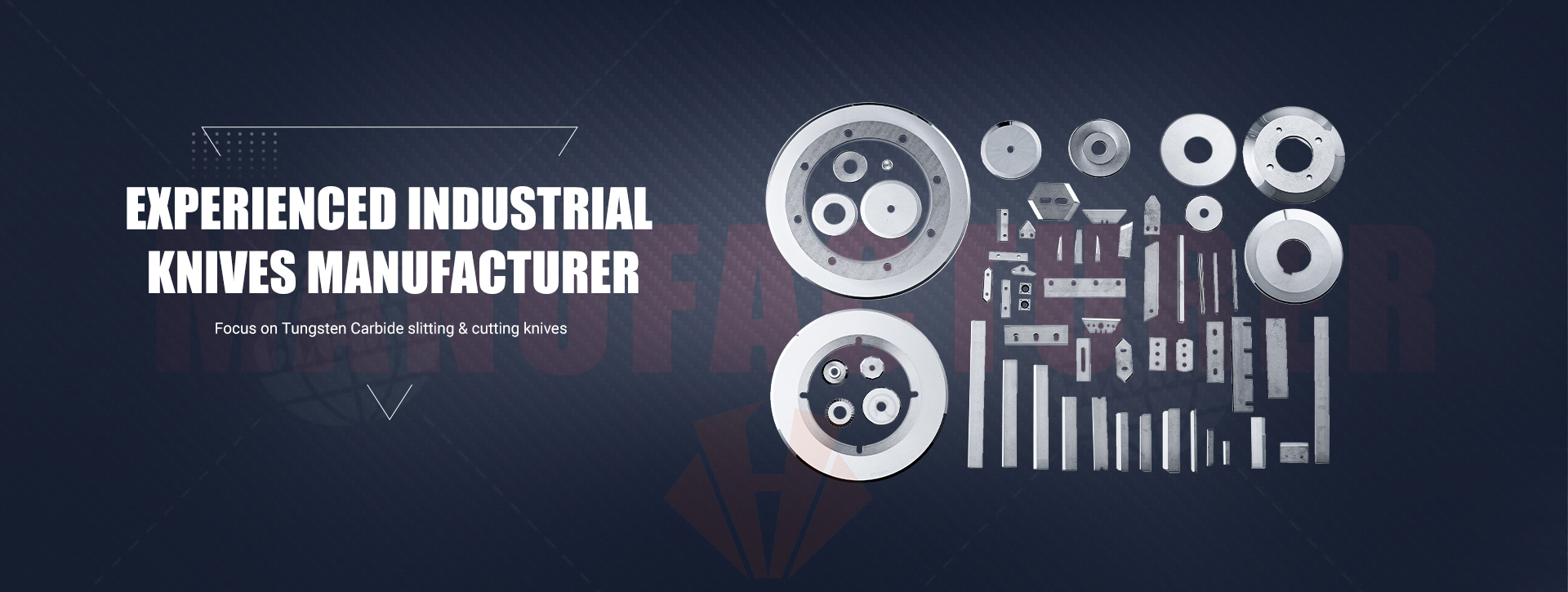

Huaxin Cemented Carbide, based in Chengdu, China, produces high-quality tungsten carbide blades for industries like packaging and textiles. Huaxin offer customizable solutions, but pricing details require reaching out to their team.

Post time: May-16-2025